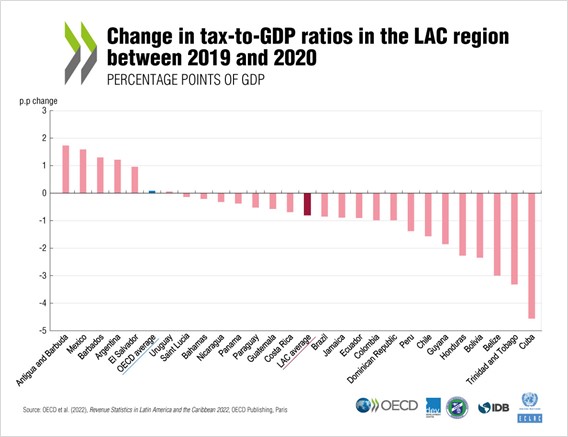

Comunicado Tax Revenues in Latin America and the Caribbean Take a Historic Hit before Showing Early Signs of Recovery | Economic Commission for Latin America and the Caribbean

Canada's commercial real estate market faces tax challenges. Learn key insights in this article. | Ragu Rajaratnam, CPA, CA posted on the topic | LinkedIn

Canada's property tax system challenges commercial real estate owners. | Willis Business Law posted on the topic | LinkedIn

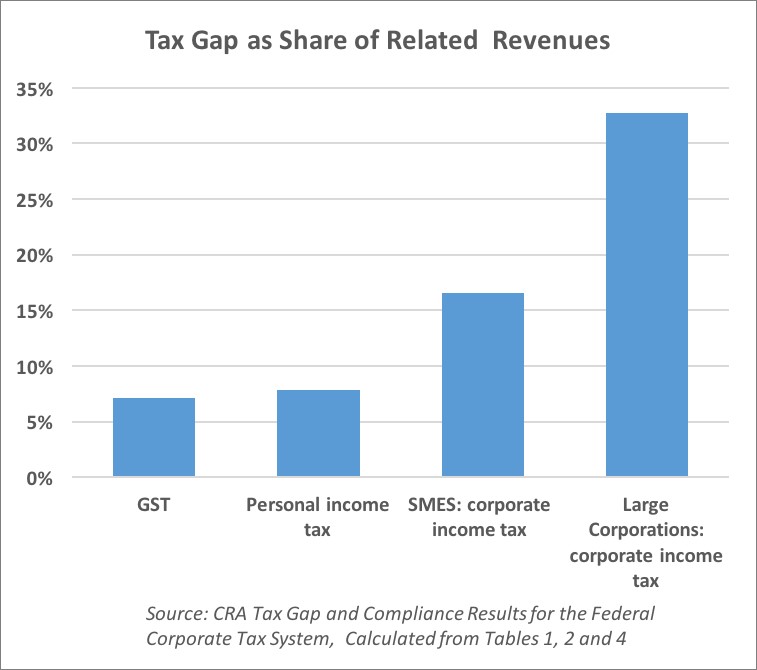

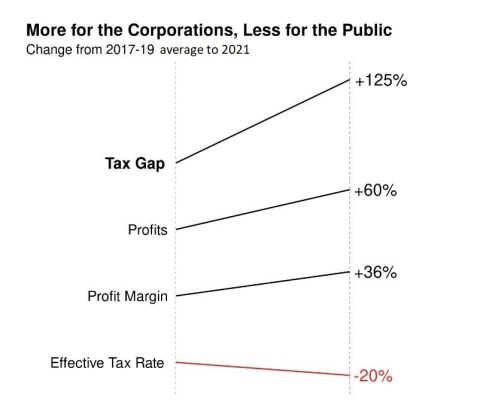

Corporations avoided paying up to $11.4-billion in 2014 tax, according to CRA report - The Globe and Mail

Canada Revenue Agency's Tax Gap Study Shows Canadians Hid Up To $240 Billion Offshore | HuffPost Business

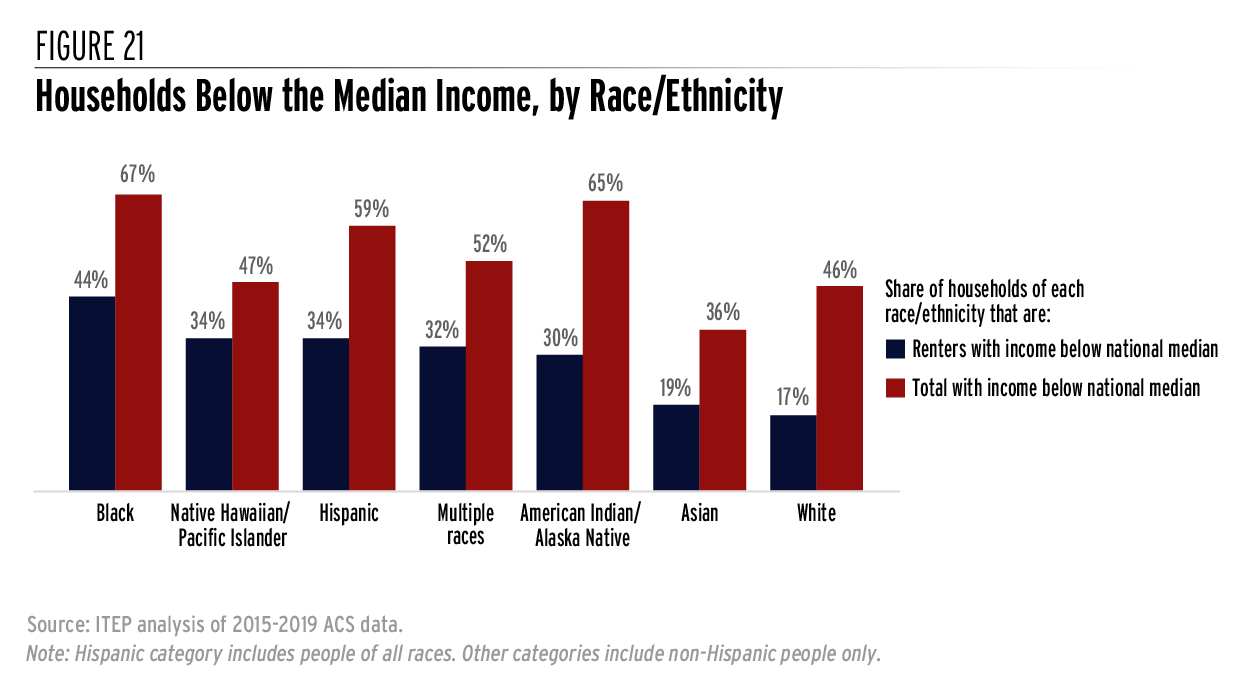

State Income Taxes and Racial Equity: Narrowing Racial Income and Wealth Gaps with State Personal Income Taxes – ITEP